Recognized as

a leader

Recognized as a leader for over 40 years, Rok is well known in the commercial real estate community for our innovative and entrepreneurial approach to acquisitions and development combined with recognizing the value of long-term appreciation and preservation.

obtaining rare opportunities

Outstanding market insights coupled with an aggressive acquisitions strategies have enabled us to create an impressive track record of astute investments, which are based upon recognizing rare opportunities and moving swiftly to take advantage of them.

knowledgeable expertise

Knowledgeable insights are critical, and once a potential property is located, extensive due diligence is conducted to make certain a proper plan of action is created to reposition the property and ensure that the highest possible return is achieved.

Private equity is used to fund most of our property purchases and it is our aim to continuously provide secure investments with strong cash flow and appreciation. Today’s high-stakes real estate environment provides significant opportunities that are not necessarily readily recognizable and that may be transient, making it essential to work with a firm that recognizes opportunities and exploits them before they disappear.

Portfolio Criteria

Rok seeks to build a diversified assortment of properties and assets in strategic locations across the United States. The company invests in properties that generate income and yield appropriate risk-adjusted returns with correspondingly low volatility, adequate liquidity, and low correlation to broad market indices.

We are guided by a disciplined investment philosophy and process. Our goal is to source, evaluate, and invest in select income-generating multifamily and commercial real estate properties that are overlooked by less experienced and less opportunistic investors, or that are too large and complex for investors with insufficient resources and infrastructure. We are also engaged in ground-up development, including a residential apartment complex in Boca Raton, as well as the redevelopment of distressed properties or select historic landmark properties.

We utilize advanced risk management techniques and portfolio modeling capabilities to professionally underwrite its acquisitions. We make investments that capitalize on market inefficiencies by opportunistically acquiring undervalued property and/or distressed loans; we seek to maximize recoveries by utilizing long-standing banking, institutional, and governmental relationships. Capital preservation and risk management are the primary objectives of the management team. We are vertically integrated and have the extensive resources and infrastructure required to source, analyze, value, purchase, service, manage and dispose of real estate properties and assets, or retain acquisitions when warranted.

We provide the potential for value-added returns based on strong, disciplined real estate management, leasing, and marketing. Our team has unsurpassed expertise in creating and implementing a management approach that will successfully invigorate the income streams and value of individual portfolio investments. The management plan is designed prior to completion of an acquisition so that it can be immediately executed upon closing. Depending on the location and property type, management may be delegated to a third-party, handled directly, or kept in place through an arrangement with the existing staff. Due to the critical nature of management in achieving value-added returns, we maintain tight supervision over every aspect of property management and operations.

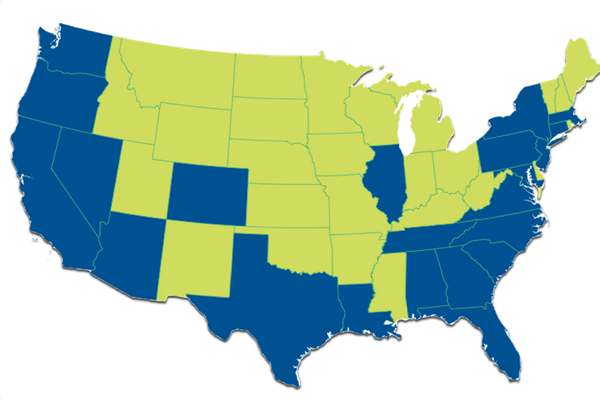

Geographic Focus

GEOGRAPHIC DIVERSIFICATION

We are seeking real estate investments located throughout the United States. Specifically, we are pursuing acquisitions in the Southeast, West, and Southwest and in select markets located in the Midwest and Northeast.

TARGETED MARKETS

- South-Florida Tri-County Area ($1M – $120M)

- Outside South Florida ($3M – $120M)

- Primary and Secondary Markets in the Southeast, West, and Southwest

- Select Markets in the Midwest and Northeast

Acquisitions Criteria

We are seeking to acquire income-producing commercial real estate properties. We look for well located assets in high-barrier-to-entry locations. As a well-capitalized private company, with many years of experience and a strong track record for closing the most complex deals, we have the ability to underwrite the most sophisticated transactions and move quickly on them.

We target multi-family and commercial real estate that has been developed in the last 15 years. We may consider properties over 15 years old that have been well maintained and/or have had substantial renovations in the last five years affecting structural and support systems, as well as cosmetic renovations. Additionally, we may pursue multi-family and commercial development opportunities, including the development of vacant land. Below is a general summary of the type of opportunities we are interested in pursuing:

Property Selection

ASSESSMENT AND EVALUATION

Investments are selected based on asset class, loan analysis, diversity and correlations.

- Risk Assessment: A stress test of individual properties and/or assets based on simulation analysis involving market scenarios, market absorption, credit spreads, interest rates, etc.

- On-going Monitoring: Continuous evaluation of properties and/or assets in terms of risk exposures, investment strategies, and scenario analysis in the context of the current market performance versus observed market conditions.

- Exit Scenario Evaluation: On-going evaluation of all possible options including sale, refinance, or other strategies, taking into account timing, local and national market factors, asset class performance, and liquidity trends.

Targeted Transactions

$1 MILLION TO $150+ MILLION

We seek to invest in real property and real estate loans. Proof of funds and references are available upon request.

- REO Investments

- Equity Investment

- Market Rate Investments

- Performing Loans

- Nonperforming Loans

- Will Consider Joint Ventures

Property Types

COMMERCIAL/ INCOME-PRODUCING

Generally, we seek properties within the following classifications:

- Retail (Power Centers, Neighborhood Community Centers, and Strip Centers)

- Multi-Family Apartment Complexes

- Self-Storage Facilities (30,000+ sf throughout East Coast)

- Office Buildings

- Mobile Home Parks (South Florida Region)

- Marinas (South Florida Region)

- Waterfront Single-Family Homes (South Florida Region)

- Industrial/Warehouse/Flex(South Florida Region)

- Vacant Land For Development

Investment Approach

We conduct rigorous quantitative, statistical, and qualitative analyses of possible investments utilizing customized models and systems. The few properties and/or assets that survive the initial process are targeted for further, more precise investigation. The ultimate goal of the process is to provide a portfolio of superior properties and/or assets which is diversified across property types and class, and geographic market. We follow a logical path to ensure sound investments, including sourcing, property review, core due diligence, investment approval, and post-investment refinements and updates.

Sourcing

We utilize strong, industry-wide relationships with local, regional, and national lenders, institutional providers, and governmental agencies.

We also call upon a vast, nationwide network of brokerage and advisory relationships, as well as research databases, proprietary industry lists, industry journals, and public records.

Property Review

Prior to an acquisition, potential investments undergo an initial review process, which may include property visits, market and comparable property analyses, historic performance review, and loan re-underwriting assessments.

The review phase is used to develop a deep understanding of the real estate and/or loans, as well as all pertinent legal documentation.

Core Due Diligence

Once we have determined that a potential investment meets our acquisitions criteria, we then subject it to rigorous core due diligence. Our broad experience in the real estate sector enables us to rapidly accomplish the necessary steps involved in core due diligence and thereby allows us to close quickly on the most complex transactions.

Our core due diligence process generally includes:

- Review of the property and/or asset data, including financial, local, legal, and market information

- Stress testing and scenario analyses appropriate for risk management

- Title searches and documentation

- Third-party valuations

- Property inspections, including detailed physical, environmental, and engineering reports as needed

- Reviews of the local economy and demographics, neighborhood economics and trends, qualitative and quantitative analyses of market competition, area rates, vacancies and market position.

Post-Investment Review

Following acquisition, investments are subject to monthly surveillance and reports with an on-going comparison of results to objectives and updating of the portfolio correlation analysis and the market/comparables analysis. A continuous post-investment review process monitors risk and adherence to risk limits and guidelines. Value enhancements are considered and reviewed throughout ownership. Exit scenarios are also monitored. On-going review enables us to respond as needed to market and financial realities and opportunities to enhance and maximize returns.

Investment Approval

An acquisition requires team review and approval, which is conducted according to a formal investment committee process. A majority approval of the acquisition team is required in order to invest in any real estate or real estate-related asset.

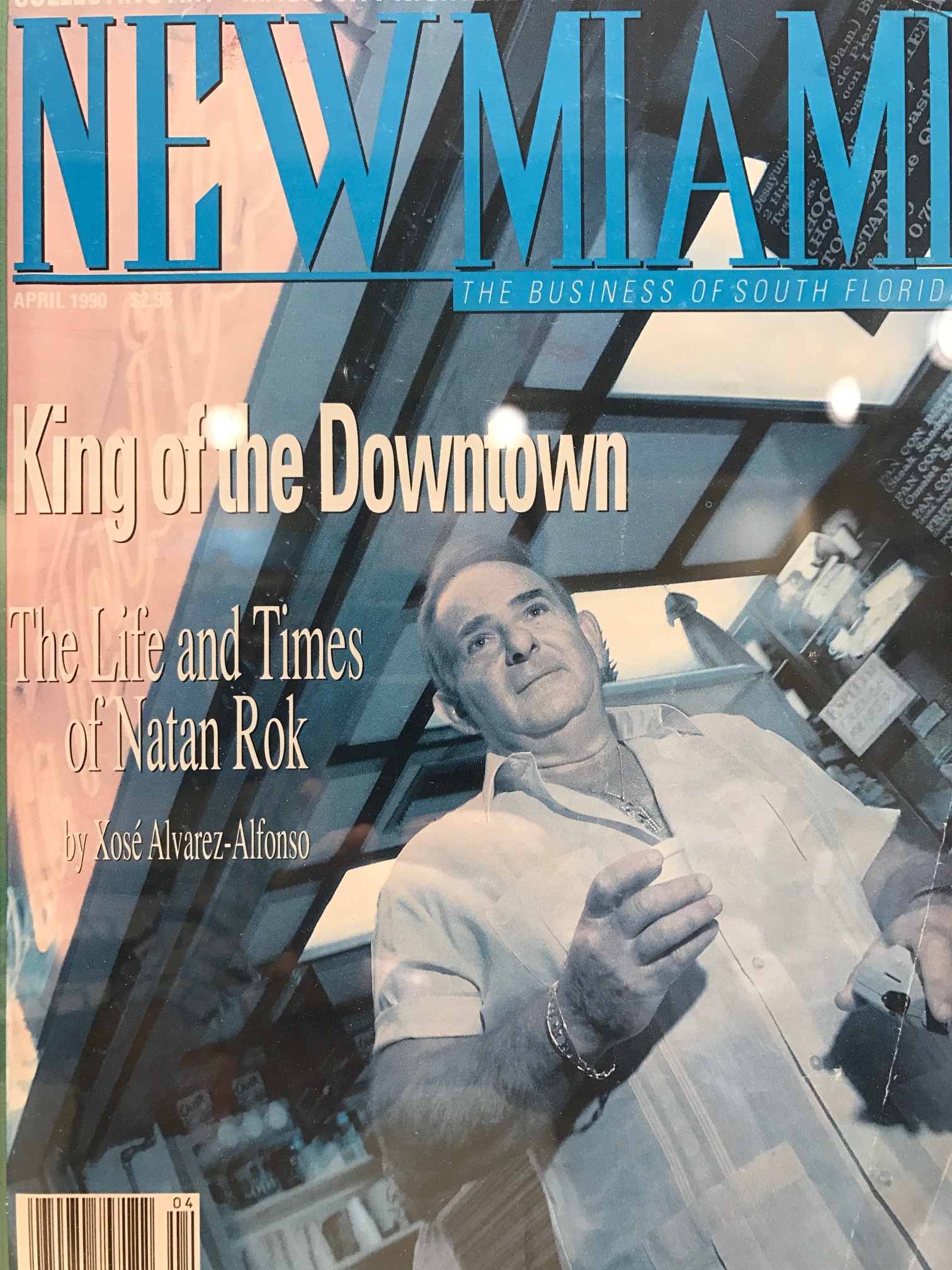

Our History

Beginning with Natan Rok, the Rok name has become synonymous with the emergence of Miami, Florida into a world-class center of commerce and the arts.

An emigrant from Cuba, Natan Rok arrived in Miami in 1964 and opened a modest retail business on historic Flagler Street. He and his son, Sergio, who joined the business in 1983, envisioned the area’s future as a true hub of cultural and commercial vibrancy.

Together they parlayed the business into a real estate empire centered on the core of the city.The Rok organization set the trend for modernization while maintaining a property’s unique character and historical charm. They also pioneered the practice of subdividing commercial properties into small retail spaces, despite predictions the idea would fail.

Along with their real estate activities, the Rok organization purchased a controlling interest in Transatlantic Bank and spent the better part of the 1990s growing the bank’s business. In 2004, Sergio Rok succeeded his father as head of Rok Enterprises and spearheaded the continued growth and eventual sale of Transatlantic Bank to one of the largest banks in Spain.

Mr. Rok has built his own reputation for real estate prowess and business acumen. In the footsteps of his father, he has continued to make significant investments and build the Rok portfolio of properties. Considered a heavy hitter among commercial real estate property owners, Mr. Rok has been integral to some of the city’s biggest deals, blending a rare talent for negotiation with keen insight into the hands-on mechanics of the retail and financial services sectors.

In 2009, Rok Acquisitions, LLC was formed to leverage the Rok organization platform and resources to pursue new real estate and real estate- related opportunities. Rok Acquisitions, LLC has been involved in some of the largest real estate-related transactions in the Southeast.

Our Mission

The Rok mission is to maintain the highest standard of quality in every area of operation and to have an outstanding team of skilled, experienced and creative professionals, leading to sophisticated operational procedures that result in consistent growth and success.

We are a private, well-capitalized real estate investment group based in downtown Miami, Florida. With over 40 years of experience, we have been involved with all facets of real estate property ownership, including the acquisition, development and management of properties across many different product types.

Our robust and diversified portfolio includes a range of properties, including commercial and retail space, institutional-quality multi-family properties, storage and warehouse facilities, historic buildings, and vacant land under development.In addition to building our current real estate portfolio, we are aggressively pursuing acquisition opportunities of both notes and mortgages as well as fee simple transactions. We have the ability to underwrite the most sophisticated and complex transactions and to move quickly to acquire them.

The Team

SERGIO ROK

Sergio Rok has over 40 years of experience as a successful entrepreneur and investor in the real estate and banking sectors. As a longtime investor in mixed-use, commercial and residential property throughout South Florida, Mr. Rok has been involved with the continuous redevelopment of the downtown Miami area and the repositioning of commercial properties throughout the region. Mr. Rok served on the board and audit, loans, and special assets and compensation committees of Transatlantic Bank from 1986 through 2006. In 2006, he oversaw the sale of Transatlantic Bank to Banco Sabadell, Spain’s fourth largest bank. He is experienced in all phases of ownership and development, including acquisition, financing, planning, permitting, design, construction, lease up, property management and disposition. He is a founding board member of the Downtown Miami Partnership, was a member of the board of the Miami Downtown Development Authority for 19 years, and has held a board position on a public REIT.

Sergio Rok has over 40 years of experience as a successful entrepreneur and investor in the real estate and banking sectors. As a longtime investor in mixed-use, commercial and residential property throughout South Florida, Mr. Rok has been involved with the continuous redevelopment of the downtown Miami area and the repositioning of commercial properties throughout the region. Mr. Rok served on the board and audit, loans, and special assets and compensation committees of Transatlantic Bank from 1986 through 2006. In 2006, he oversaw the sale of Transatlantic Bank to Banco Sabadell, Spain’s fourth largest bank. He is experienced in all phases of ownership and development, including acquisition, financing, planning, permitting, design, construction, lease up, property management and disposition. He is a founding board member of the Downtown Miami Partnership, was a member of the board of the Miami Downtown Development Authority for 19 years, and has held a board position on a public REIT.

JARED ROK

Jared Rok is currently in charge of the day to day management of Rok-owned real estate properties. He is also involved in the investment strategy and acquisition activity for the Rok organization. He attended Florida International University where he earned a Bachelor’s degree in Real estate. He is currently in the process of receiving his CCIM certification as well as his Florida real estate license.

Jared Rok is currently in charge of the day to day management of Rok-owned real estate properties. He is also involved in the investment strategy and acquisition activity for the Rok organization. He attended Florida International University where he earned a Bachelor’s degree in Real estate. He is currently in the process of receiving his CCIM certification as well as his Florida real estate license.

BRYAN MORJAIN

Bryan Morjain has been managing sophisticated real estate transactions for a decade and is experienced in every phase of property acquisition, financing, management and brokerage. Mr. Morjain has been actively involved in the real estate since the early 2000s. During that time he has participated in the acquisition, financing,leasing, brokerage, and management of numerous complex real estate transactions. He has been involved in the day to day management of Rok-owned real estate since 2004. He attended the University of Maryland, University of Autonoma Barcelona, and earned a Bachelor’s degree in Real Estate and Finance from Florida International University. Bryan has been licensed as a Florida Real Estate and Mortgage Broker since 2006 and operates a brokerage company with over 50 licensed real estate sales and broker associates.

Bryan Morjain has been managing sophisticated real estate transactions for a decade and is experienced in every phase of property acquisition, financing, management and brokerage. Mr. Morjain has been actively involved in the real estate since the early 2000s. During that time he has participated in the acquisition, financing,leasing, brokerage, and management of numerous complex real estate transactions. He has been involved in the day to day management of Rok-owned real estate since 2004. He attended the University of Maryland, University of Autonoma Barcelona, and earned a Bachelor’s degree in Real Estate and Finance from Florida International University. Bryan has been licensed as a Florida Real Estate and Mortgage Broker since 2006 and operates a brokerage company with over 50 licensed real estate sales and broker associates.

JASON MORJAIN

MICHAEL SPERLING

Michael Sperling has overseen significant commercial development projects throughout important U.S. urban and suburban metro areas. Mr. Sperling is involved in the investment strategy and acquisition activity for the Rok organization. He is experienced in both the purchase of performing and non performing loans, including the due diligence, financing, structure and legal components. He began his real estate career in the acquisition and finance division of one of the largest residential condominium developers in the United States. Prior to Rok, he worked with a New York City developer overseeing the company’s ground-up and redevelopment projects ranging in size from 50,000 – 120,000 square feet. Mr. Sperling earned a degree in Finance and Marketing from the Robert H. Smith School of Business at the University of Maryland and a Masters in Real Estate Development from Columbia University.

MARCOS MORJAIN

Marcos Morjain is the true definition of an entrepreneur. His career includes (i) the founding of a staple retail jewelry store in downtown Miami known as Ely-M Jewlery; (ii) creation of an empire in the yachting industry by owning and operating Reel Deal Yachts, Just Yacht Rentals and Miami Waterfront Investments for over 30 years. These companies have sold several thousand yachts through the distribution of twelve boat franchises, thus making him one of the largest yacht dealerships in the world. To date, Marcos has delivered yachts to several celebrities, Dignitaries, Presidents and Vice Presidents of the world and has earned their trust in confidence; (iii) Mr. Morjain has been involved in commercial real estate, both domestically and internationally, from owning and developing properties such as the Bimini Big Game (North Bimini, Bahamas) to the repositioning of what’s known today as the Fontainebleau Marina in Miami Beach the home of the Miami Yacht Show. He also owns multiple commercial warehouses throughout South Florida and across the United States.

ROBERT MOSKOVITZ, ESQ.